Learn To Save More Money

Tax Credit News From Federal Gocernment Statement

About Heating System Tax Credit The federal government wants to relieve the financial burden on owners of new heat pumps

Anyone who has a heat pump saves fossil energy, but uses more electricity – and would not benefit from the electricity price brake. This should now be balanced.

The federal government is planning a special regulation for owners of new heat pumps as part of the electricity price brake. The special regulation is intended to take into account all heat pumps that were installed in 2022.(This was announced by Federal Economics Minister Robert Habeck in Berlin)

Heating System Tax Credit For Energy Efficiency

The thermal-energetic renovation of buildings

The replacement of a fossil heating system with a climate-friendly heating system (“boiler replacement”)

What Is A Thermal-energetic Renovation Of Buildings?

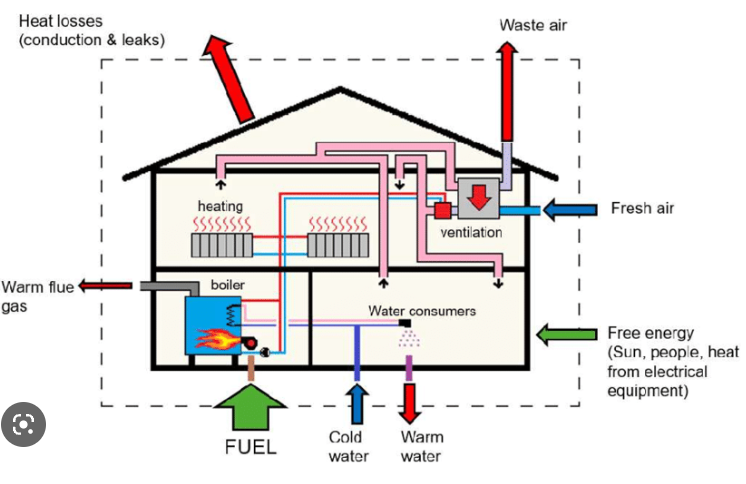

This involves renovation measures such as the insulation of exterior walls, storey ceilings, roofs and basement floors or the replacement of windows and exterior doors with the aim of improving the energy and heat efficiency of the building.

What Does Replacing A Fossil Heating System With A Climate-friendly Heating System Mean?

This means replacing a heating system based on fossil fuels (especially oil, gas, coal, coke/all-purpose burner) or electricity (night heaters or direct storage heaters) with a new, climate-friendly heating system (“boiler replacement”). Highly efficient or climate-friendly local/district heating, wood-fired central heating (e.g. pellets) or a heat pump are particularly suitable.

How Much Is The Eco Special Expenses Flat Rate?

800 euros per year are available for a subsidized thermal-energetic refurbishment and 400 euros per year for the subsidized “boiler replacement” . These amounts are automatically taken into account in the tax assessment for a total of five years , starting with the year in which the subsidy is paid out . Accordingly, a total of 4,000 euros or 2,000 euros will be effective for Heating System Tax Credit purposes.

Example: A boiler will be replaced in September 2022, and the subsidy will be paid out in December 2022. As part of the assessment for the years 2022 to 2026, a flat rate of EUR 400 each is taken into account as special expenses.

If, within these five years, further expenditure is incurred for thermal-energetic refurbishment measures and/or a boiler replacement and a subsidy is paid for this, the period taken into account is extended to ten years .

Continuation of the example: In June 2023, a thermal-energetic refurbishment will be carried out. Up to 2026, 400 euros per year will be taken into account for the boiler replacement in 2022, from 2027 to 2031, 800 euros per year will be taken into account.

Who Can Claim The Eco Special Expenses Flat Rate?

Funding recipient only . The recipient must be a natural person. In the case of condominium communities, every owner is entitled to claim.

Can a company also take advantage of the eco special expenses flat rate?

Corporations (e.g. limited liability companies, associations) are not entitled to a special expense allowance.

In the case of a partnership , the lump sum can only be taken into account for a partner if it is a natural person and the expense does not represent an operating expense.

Which Buildings Are Eligible For Subsidized Refurbishment Measures?

Only expenses for refurbishment measures that affect a privately used building or a privately used part of a building entitle you to claim the flat rate. One and two-family houses, terraced houses and apartments are therefore particularly suitable. Refurbishment measures that affect a building used for business or rented or parts of such a building are not eligible.

For this reason, it is pointed out in the funding application that only the expenses attributable to privately used parts of the building minus funding are relevant for the lump sum; in any case, these must exceed EUR 4,000 or EUR 2,000.

Examples:

- A detached house, which is used exclusively for residential purposes, is being thermally and energetically renovated. After deduction of public subsidies, the expenses amount to 17,000 euros and are entirely attributable to privately used parts of the building. The requirement for claiming the eco special expenses flat rate is met.

- A mixed-use building, 25% of which is used for business purposes and 75% for residential purposes, is being thermally and energetically renovated. After deducting public subsidies, the expenditures amount to 23,000 euros, 75% of which, ie 17,250 euros, is attributable to privately used parts of the building. The requirement for claiming the eco special expenses flat rate is met.

What Is Required For The Consideration Of The Eco Special Expenses Flat Rate?

The declaration that the lump sum is to be claimed; it must be submitted to Kommunalkredit Public Consulting as part of the application for federal funding . Furthermore, consent to data transmission to the tax office is required.

In the case of condominium communities, the property management must electronically announce in the course of the processing of the subsidy to the KPC in the final settlement for the individual apartment owners whether the special expenses flat rate should be taken into account or not.

Kommunalkredit Public Consulting transmits the data required to take the flat rate into account. The lump sum due is then automatically taken into account by the tax office as part of the income tax/employee assessment. There is no provision for a separate application as part of the assessment.

From When Can The eco Special Expenses Flat Rate Be Taken Into Account?

The assessment year 2022 will be taken into account for the first time if the application for funding was submitted after March 31, 2022 and the funding granted was paid out after June 30, 2022.

How To Choose A Climate-Friendly Heating System?(An Energy-Efficient Heat Pump)